The Major Feature of Zero-based Budgeting Is That It

The major feature of zero-based budgeting ZBB is that it O A Takes the previous years budgets and. There are many different budget techniques or processes that business organizations can employ.

Why Zero Based Budgeting Might Be The Spark Of Innovation For Businesses

Zero-based budgeting is a budgeting method that requires managers to identify every cost in the company and assign a monetary value to it.

. The major feature of zero-based budgeting ZBB is that it O A Takes the previous years budgets and adjusts them for inflation O B. The major feature of zero-based budgeting ZBB is that it A. Takes the previous years budgets and adjusts them for inflation.

Zero-based budgeting ZBB is a methodology to help align company spending with strategic goals. This is different from regular budgeting which usually starts with a last years number. A zero-based budget ZBB is built from zero start from scratch to help verify that all components of the budget are cost-effective relevant and the resources are aligned with the organizations core mission and priorities.

Focuses on planned capital outlays for property plant and equipment. Assumes all activities are legitimate and worthy of receiving budget increases to cover any increased costs. In traditional budgeting managers begin by reviewing the budget of the previous year and make corrections in revenue and expenditures based on performance expectations.

Zero Based Budgeting is a method of budgeting in which all expenses must be justified for each new period. It reviews a project from scratch on an assumption that noting is to be allowed. Assumes all activities are legitimate and worthy of receiving budget increases.

Takes the previous years budgets and adjusts them for inflation. Leonard Mereunit and Stephen Sosmick define ZBB is a technique which complements and links the existing planning budgeting and review processes it identifies alternative efficient methods of utilizing limited resources in effective attainment of selected benefits. Features of Zero Based Budgeting.

It deals with all aspects of budget requests of managers. Every new budget that is created starts from zero and the budgeting is independent of earlier targets set by the business. Each component is evaluated from a cost-benefit perspective and priorities are made.

Questions each activity and determines whether it should be maintained as it is reduced or eliminated. The major feature of zero-based budgeting ZBB is that it A. Managers have to justify that a project is essential and of high priority.

Focuses on planned capital outlays for property plant and equipment. The major feature of zero-based budgeting ZBB is that it. The purpose of the ZBB analysis is to assess a particular programs activities against its statutory responsibilities purpose cost to provide services and desired performance outcomes.

As an accounting practice zero-based budgeting offers a number of advantages including focused operations lower costs budget flexibility and strategic execution. Assumes all activities are legitimate and worthy of receiving budget increases to cover any increased costs. The major feature of zero-based budgeting is that it Evaluates each activity and determines whether it should be maintained as it is reduced or eliminated.

Questions each activity and determines whether it should be maintained as it is reduced or eliminated. Assumes all activities are legitimate and worthy of receiving budget increases to cover any increased costs. Questions each activity and determines whether it should be maintained as it is reduced or eliminated O C.

Questions each activity and determines whether it should be maintained as it is reduced or eliminated. Assumes all activities are legitimate and worthy of receiving budget increases to cover any increased costs. Takes the previous years budgets and adjusts them for inflation.

What is Zero Based-Budgeting. Takes the previous years budgets and adjusts them for inflation. Zero Based Budgeting is a reverse approach of traditional planning and decision making with respect to budgeting.

Questions each activity and determines whether it should be maintained as it is reduced or eliminated. Questions each activity and determines whether it should be maintained as it is reduced or eliminated. Assumes all activities are legitimate and worthy of receiving budget increases to cover any increased costs.

It is one of the most sustainable cost savings methods when planned and implemented correctly. It reviews critically both existing and newly proposed activities. Zero-based budgeting ZBB is a method of budgeting in which all expenses must be justified for each new period.

1261 The major feature of zero-based budgeting ZBB is that it A. Series or projects entire department or a long term project that may last several years. The major feature of zero-based budgeting ZBB is that it A.

Budgets are then built around what is needed for the upcoming period regardless of whether the budget is. ZBB requires units to justify all expenditures even ones that have been around for. Zero-based budgeting is an accounting practice that forces managers to think about how every dollar is spent in every budgeting period.

Assumes all activities are legitimate and worthy of receiving budget increases to cover any increased costs. Zero-based budgeting starts from a zero base and every function within an organization arc analyzed for its needs and costs. 4The major feature of zero-based budgeting ZBB is that it.

Questions each activity and determines whether it should be maintained as it is reduced or eliminated. The budget for a department or program to be created must always start at zero rather than a dollar amount What can the zero based budgeting be used for. The process of zero-based budgeting starts from a zero base and every function within an organization is analyzed for its needs and costs.

The concept of Zero Based Budgeting. The budget of the previous year is consequently considered to be the baseline. Zero-based budgeting or ZBB is budgeting with a reset button as it starts with zero after every period.

Questions each activity and determines whether it should be maintained as it is reduced or eliminated. Because the budget is built up from zero each manager must justify all of the expenses in his or her department. Zero-based budgeting is a method of budgeting in which all expenses must be justified and every function within an organization is analyzed for its needs and costs.

O A Takes the previous years budgets and adjusts them for inflation. What is the principal feature of zero based budgeting. It is a flexible management approach which provides credible rationale for.

Its approach requires organizations to build their annual budget from zero each year to verify all components of the annual budget are cost-effective relevant and drive improved savings. Zero-based budgeting is the process of setting up a new business or analyzing an existing one. Implemented effectively ZBB is a cost discipline enabling businesses to improve.

Zero-based budgeting enables the company to identify expenses that are not value adding or that should be reduced due to some development in production methods or something similar.

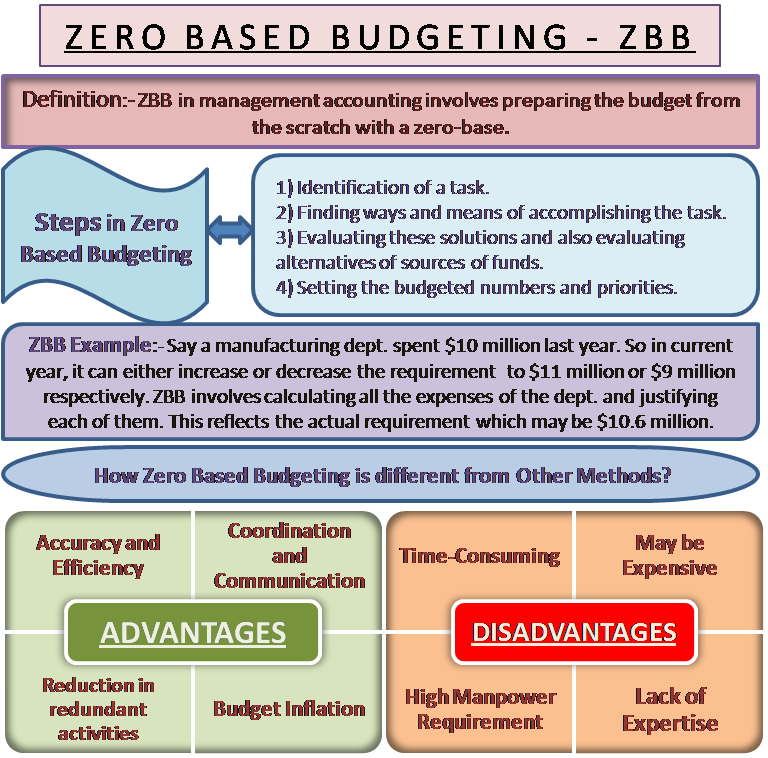

Zero Based Budgeting Meaning Steps Advantage Disadvantage

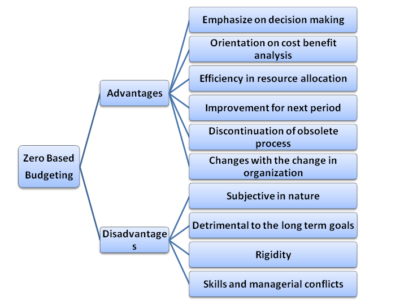

What Is Zero Based Budgeting Zbb Definition Characteristics And Stages Business Jargons

Comments

Post a Comment